Cango Inc., an emerging player in the Bitcoin mining industry, has released its operational performance data for November 2025, providing shareholders and industry observers with critical insights into the company’s mining efficiency and production capabilities. This monthly update arrives at a pivotal time for the cryptocurrency sector, as Bitcoin miners worldwide navigate evolving market dynamics, energy costs, and competitive pressures that continue reshaping the landscape of digital asset production.

The November 2025 production update from Cango Inc. offers a comprehensive view of the company’s mining operations, including Bitcoin production volumes, fleet performance metrics, and strategic initiatives designed to enhance operational efficiency. As institutional interest in Bitcoin continues growing and the network’s hash rate reaches unprecedented levels, companies like Cango face both opportunities and challenges in maintaining profitability while scaling their infrastructure. This update provides transparency into how the company is positioning itself within an increasingly competitive industry where operational excellence and strategic resource management determine long-term success.

Understanding Cango’s performance during November 2025 requires context about broader market conditions, technological developments in mining hardware, and the regulatory environment affecting cryptocurrency mining operations. The company’s ability to adapt to these factors while maintaining consistent production speaks to both its operational capabilities and strategic vision in an industry where margins can shift dramatically based on Bitcoin’s price movements, network difficulty adjustments, and energy availability.

Cango Inc.’s Position in the Bitcoin Mining Landscape

Cango Inc. represents a unique entity within the Bitcoin mining ecosystem, having transitioned from its original business focus to embrace the opportunities presented by digital asset mining. The company’s evolution reflects a broader trend of established corporations recognizing Bitcoin mining as a legitimate and potentially lucrative business vertical. Unlike pure-play mining companies that emerged specifically to mine cryptocurrency, Cango brings operational experience and corporate infrastructure from its previous business activities.

The company’s approach to Bitcoin mining emphasizes scalability and efficiency, focusing on deploying modern ASIC miners that offer optimal hash rate performance relative to energy consumption. This strategy acknowledges that success in contemporary Bitcoin mining depends less on simply accumulating mining equipment and more on optimizing the relationship between computational power, energy costs, and operational overhead. Cango’s management has consistently emphasized the importance of strategic site selection, favorable energy contracts, and maintaining mining hardware at peak performance.

Within the competitive landscape of publicly traded Bitcoin miners, Cango occupies a growing position as it continues expanding its hash rate capacity. While larger competitors like Marathon Digital and Riot Platforms command significantly greater market capitalization and mining capacity, companies like Cango represent the next tier of miners working to establish themselves as sustainable operations capable of weathering market volatility. The November 2025 update provides insight into whether the company’s growth trajectory remains on track toward its stated operational goals.

November 2025 Bitcoin Production Performance

The core of Cango’s November update centers on actual Bitcoin production achieved during the month. Bitcoin production metrics serve as the primary indicator of a mining company’s operational success, directly correlating to revenue generation and, ultimately, shareholder value. November presented particular challenges and opportunities for miners, with network difficulty adjustments and Bitcoin price movements creating a dynamic environment requiring operational flexibility.

Cango’s production figures for November 2025 reflect the combined output of its deployed mining fleet operating across its facilities. The company measures production both in absolute terms of Bitcoin mined and relative efficiency metrics that account for the hash rate deployed. These measurements provide stakeholders with insight into whether the company’s mining infrastructure is performing at expected levels or experiencing technical challenges that might impact profitability.

Production performance during November also reflects seasonal considerations affecting mining operations. Many mining facilities experience varying operational efficiency based on ambient temperatures, as cooling requirements directly impact overall energy consumption and operational costs. November’s moderate temperatures in many mining regions typically provide favorable conditions for mining operations, potentially allowing equipment to run at higher sustained output without excessive cooling overhead.

Hash Rate Capacity and Infrastructure Development

Hash rate represents the computational power dedicated to mining Bitcoin, measured in hashes per second. For mining companies, hash rate capacity directly determines their share of network-wide Bitcoin production, making it a critical metric for evaluating growth and competitive positioning. Cango’s November update includes data on its operational hash rate, providing transparency into the scale of its mining infrastructure.

The company’s hash rate during November 2025 reflects both the quantity and quality of deployed mining equipment. Modern mining hardware varies significantly in efficiency, with newer generation ASIC miners producing substantially more hash rate per unit of energy consumed compared to older models. Cango’s specific equipment composition influences its overall operational efficiency, with higher concentrations of recent-generation miners typically correlating with better profitability metrics.

Energy Efficiency and Operational Cost Management

Energy consumption represents the largest operational expense for Bitcoin miners, making energy efficiency a crucial determinant of profitability. Cango’s November update addresses the company’s energy profile, including power consumption levels, energy sourcing strategies, and initiatives to optimize the relationship between hash rate production and electricity usage. In an industry where profit margins often depend on kilowatt-hour costs measured in cents, even small efficiency improvements can significantly impact financial performance.

The company’s energy strategy encompasses both the types of mining hardware deployed and the characteristics of its power supply arrangements. Modern mining operations increasingly prioritize equipment offering the best hash rate per watt metrics, even when such equipment carries higher upfront capital costs. This calculation recognizes that over the operational lifespan of mining hardware, energy costs dramatically exceed initial equipment expenses, making efficiency paramount for long-term profitability.

Cango’s power sourcing arrangements play an equally important role in operational economics. Mining companies increasingly seek locations offering renewable energy sources or abundant natural gas supplies that provide both cost advantages and environmental benefits. The November update may include information about the company’s energy mix, revealing whether operations rely primarily on grid electricity, behind-the-meter generation, or power purchase agreements providing favorable long-term pricing.

Operational cost management extends beyond just energy to include facility overhead, equipment maintenance, personnel expenses, and administrative costs. Efficient miners maintain lean operational structures that minimize non-essential spending while ensuring technical capabilities necessary for maintaining uptime and addressing equipment issues promptly. Cango’s ability to manage these costs while scaling operations indicates operational maturity essential for competing effectively in the Bitcoin mining sector.

Mining Fleet Composition and Technology Upgrades

The specific mining equipment deployed by Cango significantly influences both current production capabilities and future scalability potential. The November 2025 update provides insight into the company’s mining fleet composition, including the types and quantities of ASIC miners in operation. This information allows analysts to assess whether the company’s technology base positions it competitively relative to peers operating more advanced or efficient equipment.

Bitcoin mining hardware advances rapidly, with manufacturers regularly introducing new models offering improved performance and efficiency. Miners face constant decisions about when to upgrade existing equipment, how aggressively to pursue new hardware acquisitions, and whether to maintain older equipment that remains marginally profitable. Cango’s approach to these technology decisions reflects its strategic priorities and financial capabilities, with different strategies appropriate depending on the company’s growth stage and capital availability.

The lifecycle management of mining equipment represents a critical operational competency. ASIC miners typically provide their highest return on investment during their first two to three years of operation, after which advancing technology and increasing network difficulty erode their competitive positioning. Successful mining companies implement structured upgrade cycles that balance maximizing returns from existing equipment while strategically investing in next-generation hardware that maintains competitive efficiency.

Fleet reliability metrics provide additional insight into operational quality. Mining equipment operates under sustained computational loads in challenging environmental conditions, making technical failures inevitable. Companies demonstrating high uptime percentages and effective maintenance protocols extract more value from their equipment investments while avoiding production losses that directly impact revenue generation. Cango’s November operational data likely includes uptime metrics indicating fleet reliability.

Strategic Partnerships and Expansion Initiatives

Mining companies increasingly recognize that sustainable success requires strategic partnerships extending beyond simply operating mining equipment. Cango’s November update may reference collaborations with energy providers, hosting facilities, equipment manufacturers, or financial partners that support the company’s operational and growth objectives. These partnerships often provide competitive advantages through improved economics, enhanced technical capabilities, or access to resources otherwise difficult to secure independently.

Hosting arrangements offer another strategic option for mining companies seeking to scale rapidly without assuming full facility development responsibilities. Professional hosting providers offer turnkey solutions including building space, power infrastructure, cooling systems, and technical support, allowing mining companies to deploy equipment quickly in proven environments. Cango’s potential use of hosting services versus self-operated facilities influences both its capital requirements and operational flexibility.

Expansion initiatives detailed in November’s update reveal the company’s growth trajectory and strategic priorities. Geographic diversification across multiple facilities or regions provides operational resilience against localized power disruptions, regulatory changes, or natural events. Companies pursuing aggressive expansion must balance growth ambitions against financial constraints and operational capacity, ensuring that scaling efforts don’t compromise operational quality or financial stability.

Market Conditions and Bitcoin Network Dynamics

Cango’s November 2025 performance occurred within specific market conditions that significantly influenced mining economics. Bitcoin price movements during the month directly impacted the dollar value of mined Bitcoin, while network difficulty adjustments affected the amount of Bitcoin produced per unit of hash rate. Understanding these external factors provides essential context for evaluating the company’s operational results.

The Bitcoin network implements difficulty adjustments approximately every two weeks, modifying the computational challenge required to mine new blocks based on recent hash rate trends. When network hash rate increases rapidly, difficulty adjustments make mining proportionally harder, requiring more computational work to produce the same amount of Bitcoin. November’s specific difficulty trajectory influenced how much Bitcoin Cango’s hash rate produced, independent of the company’s operational performance.

The broader cryptocurrency market environment also influences investor sentiment toward mining stocks. Bull markets typically drive substantial appreciation in mining company valuations as investors seek leveraged exposure to Bitcoin price increases, while bear markets often see mining stocks decline more dramatically than Bitcoin itself. Cango’s stock performance around its November update likely reflected both company-specific operational results and broader market sentiment toward the mining sector.

Financial Implications and Profitability Analysis

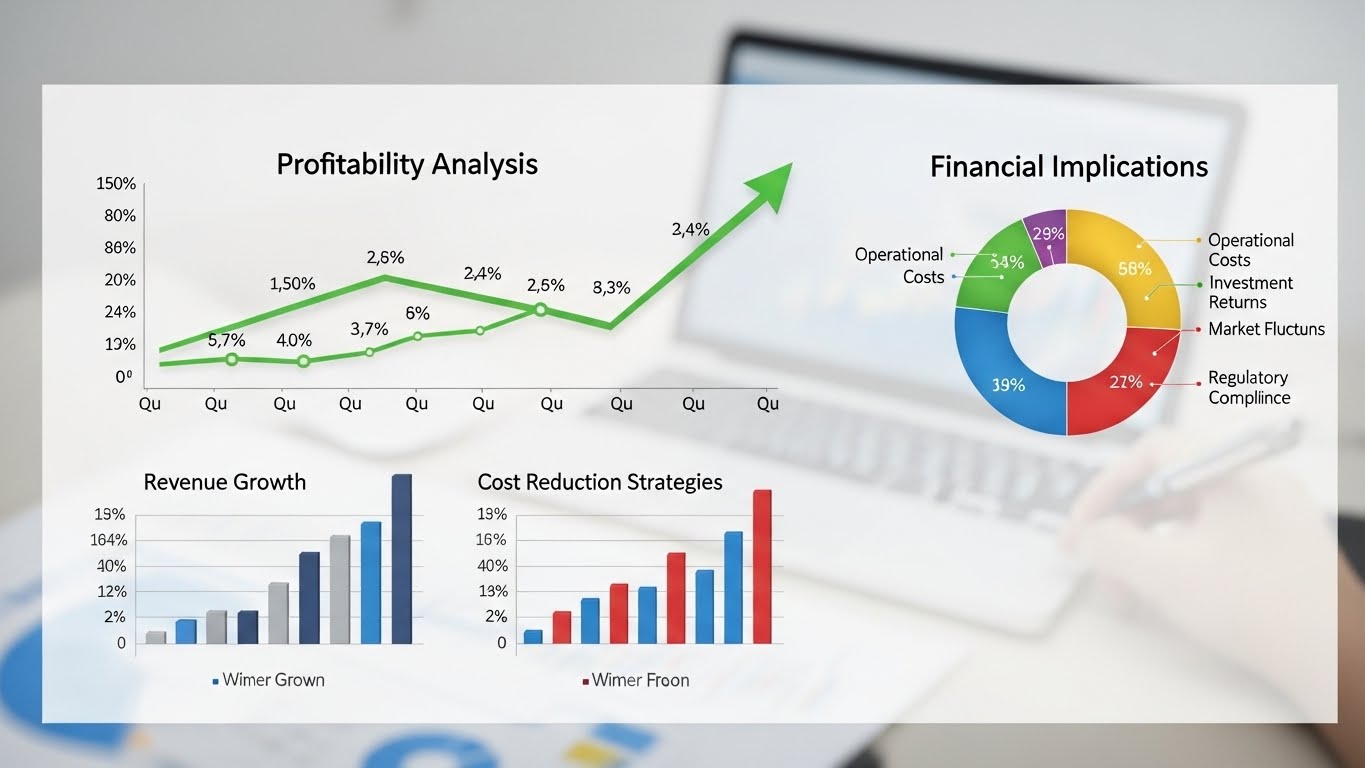

Understanding Bitcoin production volumes provides only part of the picture regarding Cango’s financial health. True profitability assessment requires analyzing the relationship between revenue generated from mined Bitcoin and the operational costs incurred producing that Bitcoin. The November 2025 update offers data points enabling stakeholders to estimate the company’s mining profitability during the period.

Operational expense analysis requires examining multiple cost categories. Energy expenses typically represent the largest line item, potentially accounting for fifty to seventy percent of total operational costs depending on local electricity rates and equipment efficiency. Personnel costs, facility expenses, equipment depreciation, maintenance, and administrative overhead comprise additional categories affecting overall profitability. Companies achieving lower per-Bitcoin production costs demonstrate operational advantages that translate directly to bottom-line performance.

The concept of cash cost per Bitcoin provides a useful metric for comparing efficiency across mining companies. This calculation divides total cash operational expenses by Bitcoin produced, revealing how much it costs the company to mine each Bitcoin before accounting for depreciation and non-cash expenses. Miners maintaining cash costs substantially below Bitcoin’s market price demonstrate profitable operations with buffers against price volatility, while those with cash costs approaching Bitcoin’s price operate on thin margins vulnerable to market fluctuations.

Regulatory Environment and Compliance Considerations

Bitcoin mining operations worldwide face increasing regulatory scrutiny as governments develop frameworks addressing cryptocurrency activities, energy consumption, and environmental impacts. Cango’s November 2025 operations occurred within evolving regulatory landscapes that influence both current operations and strategic planning for future growth. Understanding these regulatory considerations provides important context for assessing the company’s risk profile and growth potential.

Environmental regulations increasingly affect mining operations, particularly concerning energy consumption and carbon emissions. Growing pressure from environmental advocacy groups and climate-conscious investors pushes mining companies toward renewable energy sources and carbon-neutral operations. Companies documenting their environmental impact and implementing sustainability initiatives often find better access to capital markets and improved public perception compared to those ignoring environmental considerations.

Compliance requirements extend beyond just environmental considerations to include financial reporting standards, securities regulations, tax obligations, and cryptocurrency-specific rules. Publicly traded mining companies like Cango face particular scrutiny from securities regulators regarding financial disclosures, corporate governance, and investor communications. The company’s transparency through regular operational updates like the November report demonstrates commitment to regulatory compliance and investor relations best practices.

Future Outlook and Strategic Priorities

While the November 2025 update focuses primarily on historical performance, it likely includes forward-looking statements regarding Cango’s strategic priorities and growth objectives. These projections provide investors with management’s perspective on the company’s trajectory and the initiatives planned to drive future value creation. Understanding these strategic priorities helps stakeholders assess whether management’s vision aligns with their investment thesis.

Capacity expansion remains a primary focus for most growing mining companies. Cango’s planned hash rate growth, equipment procurement timelines, and facility development initiatives indicate the scale of ambition driving the company forward. However, growth plans must be evaluated against financial resources, operational capabilities, and market conditions that might necessitate adjustments to original timelines or scopes.

Technology adoption strategies also shape future competitiveness. The mining industry continues evolving with new equipment generations, facility design innovations, cooling technologies, and operational software improving efficiency and reducing costs. Companies embracing innovation while managing technology risk effectively position themselves for long-term success in an industry where standing still means falling behind competitors investing aggressively in advancement.

Financial strategy considerations including capital allocation priorities, Bitcoin holding policies, and shareholder return mechanisms provide additional insight into management’s priorities. Some mining companies prioritize aggressive growth through reinvestment of all available capital, while others balance growth with shareholder distributions or debt reduction. Understanding Cango’s specific approach helps investors determine whether the company’s strategy matches their investment preferences.

Conclusion

Cango Inc.’s November 2025 Bitcoin production and mining operations update provides valuable transparency into the company’s operational performance during a dynamic period for the cryptocurrency mining industry. The update reveals critical metrics including Bitcoin production volumes, hash rate capacity, energy efficiency, and strategic initiatives that collectively define the company’s current state and future trajectory. As Bitcoin mining continues maturing from a niche activity to a significant industrial sector, companies like Cango must demonstrate operational excellence, strategic vision, and financial discipline to succeed.

The November results position Cango within the broader competitive landscape of Bitcoin miners, revealing whether the company is successfully scaling operations while maintaining efficiency standards necessary for profitability. As network difficulty increases and competition intensifies, only miners combining favorable energy costs, modern efficient equipment, and effective operational management will thrive long-term. Cango’s transparency through regular updates provides stakeholders with the information necessary to assess whether the company possesses these success factors.

Looking forward, Cango’s ability to execute on strategic priorities including capacity expansion, technology upgrades, and operational optimization will determine whether it emerges as a significant player in the Bitcoin mining sector or struggles to compete against larger, better-capitalized rivals. The November 2025 update represents one data point in an ongoing story of growth, adaptation, and competition within one of the cryptocurrency industry’s most essential and dynamic segments.

FAQs

Q: How does Cango Inc.’s Bitcoin production compare to larger mining companies?

Cango Inc. operates at a smaller scale compared to industry leaders like Marathon Digital, Riot Platforms, or CleanSpark, which collectively account for significant portions of North American hash rate. While these major players might produce hundreds of Bitcoin monthly with hash rates exceeding multiple exahashes per second, emerging miners like Cango typically operate with smaller fleets producing correspondingly lower absolute Bitcoin volumes. However, efficiency metrics like cost per Bitcoin mined and hash rate growth trajectories often matter more than absolute size for evaluating long-term potential. Smaller miners can achieve superior returns if they secure favorable energy contracts, deploy cutting-edge equipment, and maintain operational excellence that larger competitors might struggle to match across massive fleets.

Q: What factors most significantly impact Cango’s mining profitability?

Three primary factors determine mining profitability for Cango and similar operations. First, Bitcoin’s market price directly affects revenue generated per coin mined, with higher prices improving margins and lower prices potentially rendering operations unprofitable. Second, energy costs represent the largest operational expense, making electricity rates and mining equipment efficiency crucial profitability determinants. Third, network difficulty affects how much Bitcoin a given amount of hash rate produces, with increasing difficulty requiring more computational work for the same production. Additional factors including equipment reliability, facility overhead costs, and Bitcoin holding strategies versus immediate sales also influence overall financial performance, but these three primary variables drive the fundamental economics of mining operations.

Q: How does network difficulty affect Cango’s Bitcoin production?

Network difficulty represents a dynamic adjustment mechanism that ensures new Bitcoin blocks are mined approximately every ten minutes regardless of total network hash rate. When more miners join the network or existing miners deploy additional capacity, difficulty increases proportionally, making each individual miner’s hash rate less productive in absolute Bitcoin terms. For Cango, this means that maintaining consistent Bitcoin production requires continuously growing hash rate capacity just to offset network-wide difficulty increases. If Cango’s hash rate remains static while network hash rate grows, the company’s Bitcoin production will gradually decline as difficulty adjustments make mining proportionally harder. This dynamic creates constant pressure on miners to upgrade equipment, expand facilities, and improve efficiency simply to maintain their competitive position.

Q: Does Cango sell its mined Bitcoin immediately or hold it as a treasury asset?

Mining companies adopt different Bitcoin disposition strategies based on their financial situations, growth priorities, and Bitcoin price outlooks. Some miners sell Bitcoin immediately upon receiving mining rewards, using proceeds to fund operational expenses, debt service, and capacity expansion. This approach provides steady cash flow and eliminates Bitcoin price exposure but forgoes potential appreciation. Other miners adopt HODL strategies, retaining significant Bitcoin on balance sheets as treasury assets, betting that long-term appreciation will exceed returns from alternative uses of those funds. Many companies pursue hybrid approaches, selling portions to fund operations while retaining reserves for potential appreciation. Cango’s specific strategy may be detailed in their financial reports and operational updates, with the approach potentially shifting based on market conditions and capital needs.

Q: What risks should investors consider when evaluating Cango’s mining operations?

Bitcoin mining investments carry multiple risk categories that investors must evaluate. Bitcoin price volatility represents the most obvious risk, as dramatic price declines can quickly transform profitable operations into loss-generating ventures. Regulatory risk encompasses potential government restrictions on mining activities, unfavorable tax treatments, or environmental regulations limiting operations. Operational risks include equipment failures, power disruptions, cybersecurity threats, and natural disasters affecting facilities. Competitive risk intensifies as more miners deploy advanced equipment, increasing network difficulty and reducing individual miners’ production efficiency. Financial risks include debt obligations that might become challenging to service during adverse market conditions, dilution from equity financing, and working capital constraints. Technology risk involves equipment obsolescence as new generations of mining hardware render older models economically unviable. Investors should assess Cango’s specific exposure to each risk category and evaluate whether potential returns justify these combined risk factors.