As the new year begins, investors are once again reassessing their exposure to digital assets, and cryptocurrency-related stocks are moving back into focus. Early January often brings renewed optimism, portfolio rebalancing, and fresh capital allocation, especially after volatile year-end market movements. In this environment, cryptocurrency stocks offer a unique bridge between traditional equity markets and the rapidly evolving digital asset ecosystem.

Rather than holding cryptocurrencies directly, many investors prefer gaining exposure through publicly traded companies that operate within the crypto industry. These firms provide regulatory clarity, audited financials, and access through conventional stock exchanges, making them attractive to both institutional and retail investors. As the crypto market shows signs of renewed momentum, identifying the most strategically positioned companies becomes increasingly important.

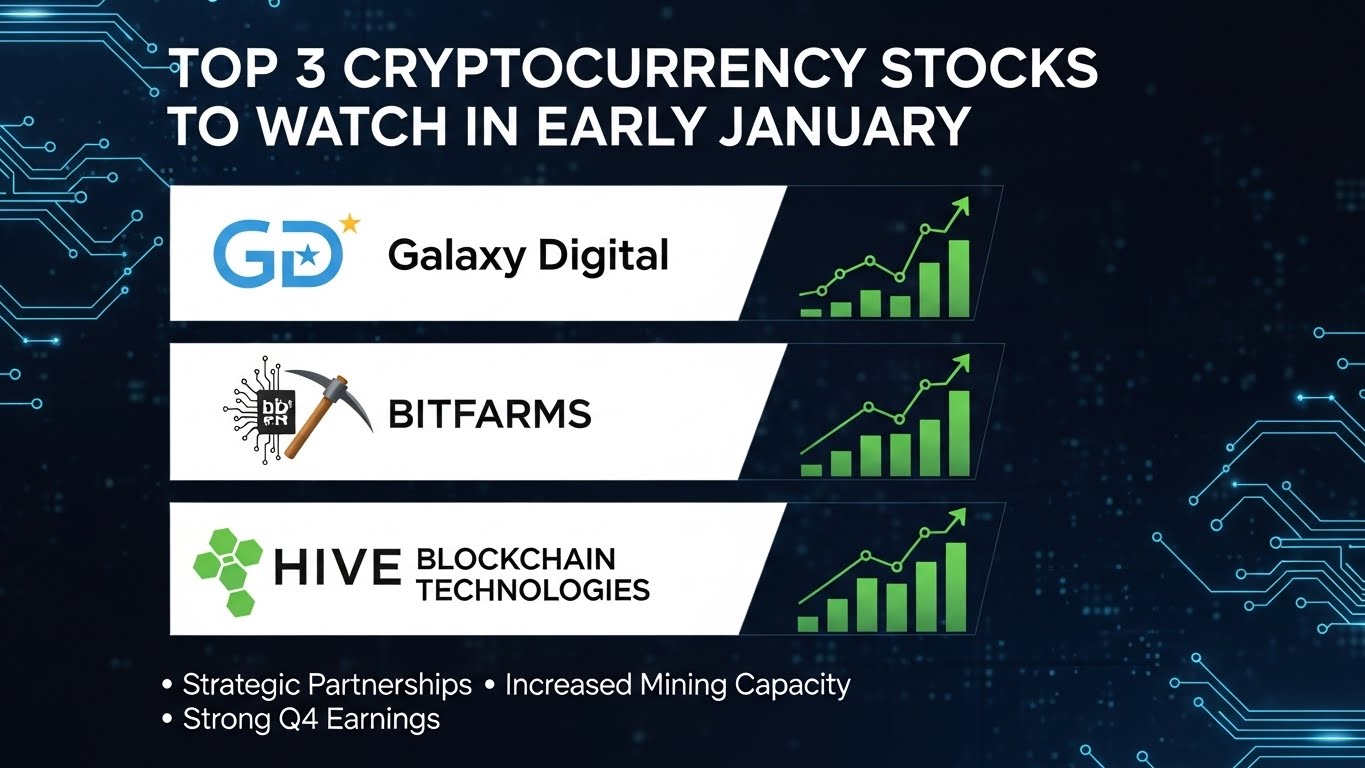

This article takes a deeply analytical look at the top 3 cryptocurrency stocks to watch in early January, focusing on Galaxy Digital, Bitfarms, and HIVE. Each company represents a different segment of the crypto economy, from digital asset investment and infrastructure to Bitcoin mining and blockchain services. By examining their business models, market positioning, and broader industry trends, we aim to provide a comprehensive perspective on why these stocks deserve close attention at the start of the year.

Why cryptocurrency stocks matter in early January

Seasonal market dynamics and investor behavior

Early January is a critical period for financial markets. After tax-loss harvesting and reduced activity in December, investors return with refreshed strategies and renewed risk appetite. This seasonal shift often leads to increased trading volumes and stronger price discovery across growth-oriented sectors, including crypto-related equities.

Cryptocurrency stocks tend to amplify underlying crypto market movements. When digital assets gain momentum, stocks tied to the sector often experience outsized reactions due to operating leverage and speculative interest. This makes early January an especially important window for identifying potential leaders.

Indirect exposure to digital assets

For many investors, direct crypto ownership still carries perceived risks related to custody, regulation, and volatility. Crypto stocks provide indirect exposure while maintaining the familiar structure of equity investing.

Companies like Galaxy Digital, Bitfarms, and HIVE allow investors to participate in the upside of crypto adoption, infrastructure growth, and institutional engagement without holding tokens directly. This dynamic increases their relevance during periods of renewed market interest.

Galaxy Digital as a diversified crypto investment powerhouse

Understanding Galaxy Digital’s business model

Galaxy Digital operates at the intersection of traditional finance and the digital asset economy. Its diversified business model spans asset management, trading, investment banking, and blockchain infrastructure. This multi-pronged approach allows Galaxy Digital to capture value across different phases of the crypto market cycle.

Unlike pure-play mining companies, Galaxy Digital benefits from market volatility rather than being solely dependent on crypto prices rising. Trading revenue, advisory services, and asset management fees provide multiple income streams that help stabilize performance during market fluctuations.

Institutional adoption and strategic positioning

Galaxy Digital’s focus on institutional clients sets it apart from many competitors. As large investors increasingly seek regulated and professional exposure to digital assets, Galaxy’s platform serves as a gateway for capital entering the crypto ecosystem. In early January, institutional portfolio adjustments often drive market trends. Galaxy Digital’s alignment with institutional demand positions it as a key beneficiary if capital flows back into crypto-related investments.

Galaxy Digital’s role in the evolving crypto market

Exposure to multiple crypto narratives

Galaxy Digital is not tied to a single crypto narrative. It participates in digital asset trading, venture investments, decentralized finance exposure, and blockchain infrastructure. This diversification allows the company to adapt as market themes shift. Whether the focus is on Bitcoin, Ethereum, tokenization, or institutional adoption, Galaxy Digital maintains exposure across the ecosystem. This adaptability enhances its appeal as a long-term crypto stock to watch.

Risk management and market resilience

Diversification also plays a role in risk management. During periods of crypto market stress, Galaxy Digital’s varied revenue streams can offset downturns in specific segments. This resilience makes the stock particularly interesting for early January investors seeking exposure without excessive concentration risk.

Bitfarms and the industrial scale of Bitcoin mining

Bitfarms’ mining-focused strategy

Bitfarms represents the infrastructure backbone of the Bitcoin network. As a Bitcoin mining company, its core business involves securing the network through computational power while earning block rewards and transaction fees.

The company focuses on large-scale mining operations, leveraging energy-efficient facilities and geographic diversification. This scale-driven approach allows Bitfarms to compete effectively in an increasingly competitive mining landscape.

The importance of hash rate and efficiency

Mining success depends heavily on hash rate and operational efficiency. Bitfarms has consistently invested in upgrading hardware and optimizing energy usage to maintain competitiveness. As Bitcoin mining difficulty adjusts and market conditions evolve, efficient operators like Bitfarms are better positioned to sustain profitability, making the stock particularly relevant in early January when mining economics often come under renewed scrutiny.

Bitfarms in the context of market cycles

Sensitivity to Bitcoin price movements

Bitfarms’ performance is closely tied to Bitcoin prices. When Bitcoin rises, mining revenue increases, often leading to amplified stock price movements. This leverage attracts investors seeking higher beta exposure to Bitcoin trends. Early January often sets the tone for Bitcoin’s yearly trajectory. If bullish sentiment emerges, mining stocks like Bitfarms can become focal points for speculative and strategic capital.

Long-term infrastructure investment

Beyond short-term price action, Bitfarms represents long-term investment in blockchain infrastructure. Mining companies play a crucial role in network security and decentralization. This fundamental importance supports the case for Bitfarms as more than just a speculative play, particularly as institutional interest in Bitcoin infrastructure grows.

HIVE and its diversified blockchain approach

HIVE’s dual exposure to mining and blockchain services

HIVE differentiates itself by combining cryptocurrency mining with broader blockchain-related services. While it maintains exposure to Bitcoin and Ethereum mining, it also emphasizes sustainable operations and data center capabilities. This hybrid model provides flexibility as the crypto industry evolves. HIVE’s ability to pivot between mining and other blockchain use cases enhances its long-term relevance.

Sustainability and energy considerations

Environmental concerns have become increasingly important in crypto investing. HIVE has positioned itself as a company focused on green energy solutions and sustainable mining practices. This emphasis aligns with growing investor demand for environmentally responsible operations, particularly among institutional investors evaluating crypto-related equities.

HIVE’s strategic appeal in early January

Balanced exposure to crypto growth

HIVE’s diversified approach reduces reliance on a single asset or revenue source. This balance can appeal to investors seeking exposure to crypto growth without excessive volatility. In early January, when investors reassess risk profiles, HIVE’s structure may attract those looking for stability within the crypto equity space.

Market perception and valuation dynamics

HIVE’s valuation often reflects broader crypto sentiment rather than just mining economics. This makes the stock sensitive to shifts in investor perception and market narratives. As optimism returns to the sector, HIVE can benefit from renewed attention and capital inflows.

Comparing Galaxy Digital, Bitfarms, and HIVE

Different paths to crypto exposure

Galaxy Digital, Bitfarms, and HIVE represent three distinct approaches to crypto investing. Galaxy Digital offers diversified financial services exposure, Bitfarms focuses on industrial-scale Bitcoin mining, and HIVE blends mining with broader blockchain operations. This diversity allows investors to choose exposure based on risk tolerance, market outlook, and investment horizon.

Risk and reward considerations

Each stock carries unique risks. Galaxy Digital is exposed to market volatility and regulatory developments, Bitfarms faces mining competition and energy costs, and HIVE must balance operational efficiency with sustainability goals. Understanding these trade-offs is essential when evaluating the top cryptocurrency stocks to watch at the start of the year.

Macro trends influencing crypto stocks in early January

Market sentiment and liquidity conditions

Crypto stocks are highly sensitive to macroeconomic conditions. Interest rates, liquidity, and broader risk sentiment influence capital flows into growth assets. Early January often brings renewed liquidity as institutional investors deploy capital. This environment can support upward momentum in crypto-related equities.

Regulatory clarity and institutional confidence

Regulatory developments continue to shape the crypto landscape. Increased clarity tends to boost confidence and attract institutional participation. Companies with strong governance and transparent operations, such as Galaxy Digital, Bitfarms, and HIVE, are better positioned to benefit from improving regulatory sentiment.

Long-term outlook for cryptocurrency stocks

Beyond short-term price movements

While early January presents tactical opportunities, long-term investors should consider structural trends. Adoption of digital assets, expansion of blockchain infrastructure, and integration with traditional finance all support sustained growth. Cryptocurrency stocks offer leveraged exposure to these trends, amplifying both risks and rewards.

Building a diversified crypto equity strategy

Rather than focusing on a single company, many investors view crypto stocks as part of a diversified strategy. Combining exposure to financial services, mining, and infrastructure can help balance volatility. Galaxy Digital, Bitfarms, and HIVE together provide a comprehensive snapshot of the crypto equity landscape.

Conclusion

As the market enters a new year, identifying the top 3 cryptocurrency stocks to watch in early January requires a thoughtful analysis of business models, market positioning, and broader industry trends. Galaxy Digital stands out for its diversified exposure and institutional focus, Bitfarms represents high-leverage exposure to Bitcoin mining and infrastructure, and HIVE offers a balanced approach with an emphasis on sustainability.

These companies are not merely speculative plays but key participants in the evolving crypto ecosystem. Their performance in early January may set the tone for broader crypto equity trends throughout the year. For investors seeking indirect exposure to digital assets through regulated markets, these three stocks deserve close attention as the crypto narrative continues to unfold.

FAQs

Q: Why are cryptocurrency stocks especially important to watch in early January?

Early January is a period of renewed investor activity, portfolio rebalancing, and increased liquidity. Cryptocurrency stocks often react strongly during this time as market sentiment resets and capital flows return to growth-oriented sectors.

Q: How does Galaxy Digital differ from crypto mining stocks?

Galaxy Digital operates as a diversified financial services firm within the crypto industry, generating revenue from trading, asset management, and advisory services. In contrast, mining stocks like Bitfarms focus primarily on validating blockchain transactions and earning mining rewards.

Q: Are Bitcoin mining stocks like Bitfarms highly risky investments?

Bitcoin mining stocks carry higher risk due to their sensitivity to Bitcoin prices, energy costs, and mining difficulty. However, they also offer higher potential rewards during bullish market phases, making them attractive to risk-tolerant investors.

Q: What makes HIVE attractive compared to other crypto stocks?

HIVE’s diversified approach, combining mining with broader blockchain services and a focus on sustainable energy, offers a more balanced exposure to the crypto sector. This can appeal to investors seeking growth with an emphasis on environmental responsibility.

Q: Can cryptocurrency stocks perform well even if crypto prices stagnate?

Some cryptocurrency stocks, particularly diversified firms like Galaxy Digital, can generate revenue through services and infrastructure even during flat crypto markets. However, overall performance is still influenced by broader market sentiment and digital asset trends.