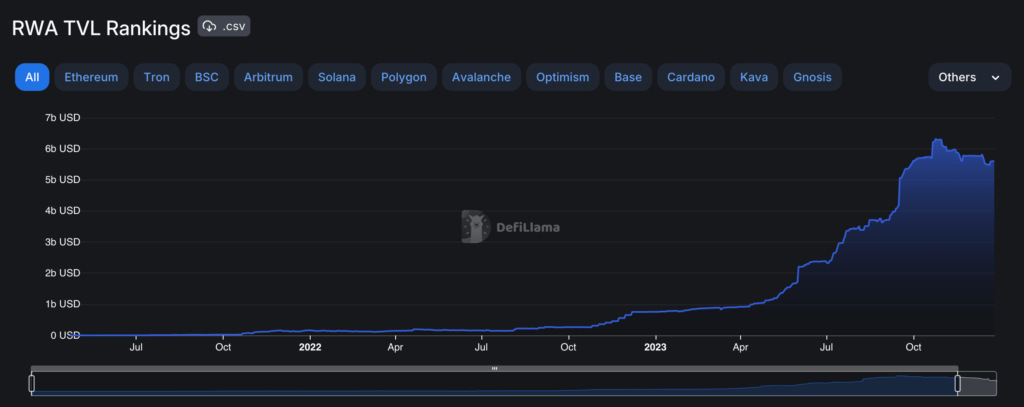

RWA Sector Growth Surge has become a key focus in 2024 as the real-world asset market sees exponential growth, reaching a total value of $8.217 billion. The surge in their value over the last several years demonstrates this. According to the most recent information that the firm has made public, the total value locked in (TVL) of DeFiLlama has reached an all-time high of $8.217 billion, with a jump of $1 billion just in the preceding seven days. We obtained this information from the company’s website. This is a significant improvement compared to the previous week’s progress.

RWA Sector Investments

Leading companies in the market, like Usual, which makes stablecoins, and Hashnote, which manages investments for decentralized finance DeFi, are at the front of this rapid growth. According to data from DeFiLlama, Hashnote grew by 65.58% in a week, while Usual grew by 65.65%, a little more than Hashnote’s growth. The first has a TVL of $1.497 billion, and the second one went up to $1.445 billion. In 30 days, the number went up 230% for Usual and stayed the same at 217% for Hashnote.

Both of these things added up to more than 35% of the value of the assets locked up in the RWA sector. Usual did well after getting $10 million in funding from a Series A round led by Binance Labs and Kraken Ventures. There were also claims that hackers broke into the X account of Department of Government Efficiency (D.O.G.E.) co-lead Vivek Ramaswamy and used it to spread false information about a partnership between the U.S. government and the stablecoin project.

This caused the price of its governance token to reach a new all-time high. Besides the top two, sites like Franklin Templeton, Ethena, Nest Staking, and MatrixDock also gained approval. The value of Nest Staking Lock rose by more than 58% in a week, reaching $66.24 million. However, MatrixDock, which works with two chains, went up 48.18 per cent, while Ethena only went up 12.3 per cent.

RWA Tokenization Shift

According to DeFiLlama’s data, not all protocols grew simultaneously. For example, Solv Protocol, DigiFT, Danogo, KlimaDAO, and Fortunafi saw their values drop differently. Danogo lost the most over the past seven days. Their $4 million TVL is over 15% less than a week ago. Of all the projects with higher caps, Solv lost the most locked value, going from $712.81 million to more than 10% less. But over 30 days, Maker RWA’s value dropped by 65%, bringing the total value of the assets it held down to $290.7 million.

There may be a change in how standard assets are handled, sold, and viewed because of the rise in RWA tokenization. Recently, several companies in the lithium mining industry in Argentina said they wanted to use Cardano to tokenize the possibly trillion-dollar business. BlackRock and other big financial companies have also helped make the space more legitimate through its BUIDL project.

Related: Bitcoin DeFi Growth Powers Blockchain Innovation in 2025

Summary

The RWA Sector Growth Surge has been remarkable, growing by $1 billion in just seven days and bringing its total value locked (TVL) to a record $8.217 billion. Big companies like Usual and Hashnote are driving this growth. Usual is growing by 65.65% per week, and Hashnote is growing by 65.58%. These companies have made big changes in the RWA industry. For example, Usual got $10 million in Series A funding from Binance Labs and Kraken Ventures.

Even though the biggest players saw substantial growth, the value of some protocols, such as Solv Protocol, DigiFT, Danogo, KlimaDAO, and Fortunafi, decreased. It’s worth noting that Danogo’s value dropped by more than 15%, and Solv’s TVL dropped by a lot. Maker RWA lost the most money over 30 days, dropping 65%.

The growing use of RWA tokens, such as Argentine lithium mines’ plans to use Cardano to tokenize the trillion-dollar lithium industry, shows a change in how standard assets are handled and sold—big financial companies like BlackRock also have legitimacy in the field with projects like its BUIDL project.